Synopsis

Asian shares displayed caution as investors reacted to President Trump's firm stance on tariffs, ruling out deadline extensions. Copper futures declined following Trump's tariff threats, impacting global metal markets. Despite progress with the EU, potential tariffs on US technology firms remain a concern, leading to market indifference unless economic data weakens or inflation surges.

TIL Creatives

TIL CreativesShe continued to recommend phasing into global equities or diversified portfolios to navigate volatility ahead.

Asian shares opened cautiously as investors held back from taking risky bets after President Donald Trump ruled out extending his August deadline. Copper futures fell on Trump’s tariff threat.

Shares in Japan rose and those in Australia fell while a broader gauge of Asian shares dipped 0.1%. Benchmark copper futures fell in London after Trump said he planned to implement a 50% tariff on imports, a move that’s likely to spark further upheaval in global metal markets. US copper prices had a record gain in the last session on Trump’s remarks.

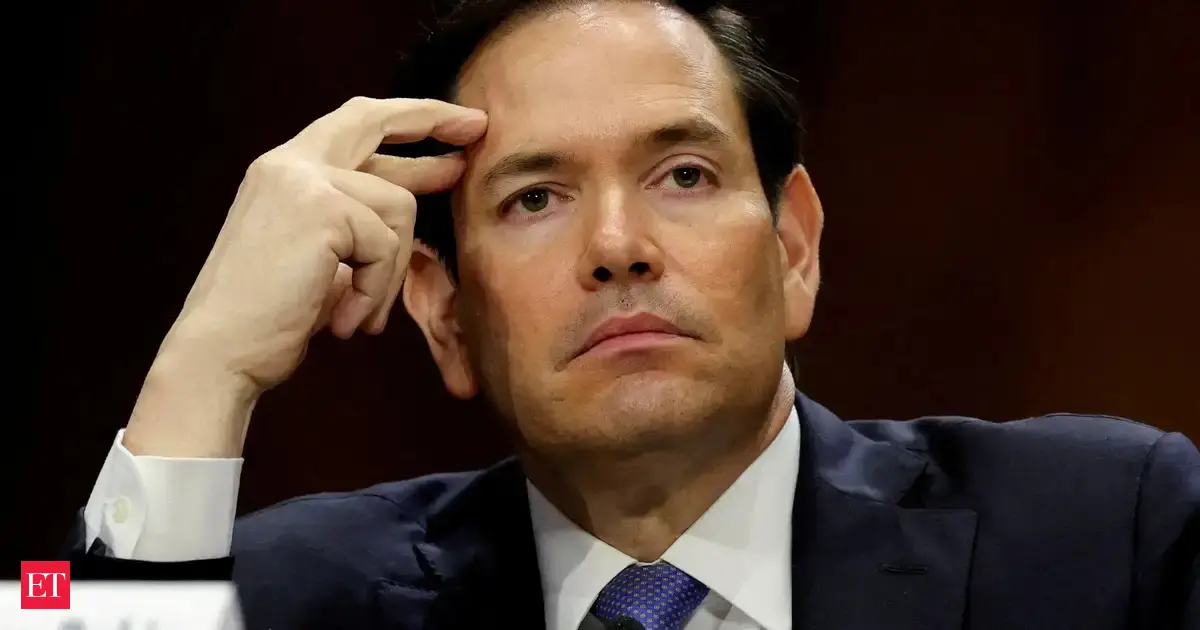

Trump signaled a renewed determination to push ahead with his plans to heavily tax foreign imports. He also told reporters that despite progress with the European Union on a trade deal, frustration over the bloc’s taxes and fines targeting US technology firms could result in him unilaterally declaring a new tariff rate within the next two days.

“The market’s response to this week’s barrage of tariff headlines has been one of indifference, having absorbed the lessons of Liberation Day, where timelines were extended, levy rates were reduced, and trade deals were brokered,” said Tony Sycamore, a market analyst at IG Australia. “This indifference is expected to continue until either the hard economic data starts to turn lower or inflation spikes higher.”

Trump vowed to push forward with his aggressive tariff regime in the coming days, stressing he would not offer additional extensions on country-specific levies set to now hit in early August while indicating he could announce substantial new rates on imports of copper and pharmaceuticals.

The posturing on social media and at a Cabinet meeting on Tuesday came after traders initially shrugged off a series of letters and executive actions Trump issued Monday, pushing back the deadline for his so-called “reciprocal” tariffs while announcing the latest rates he planned for more than a dozen countries that had not succeeded in brokering quick trade agreements.

“While tariffs will likely remain high — compared with levels at the start of the year — as will the headline risk, we think the US effective tariff rate should end the year at around 15%,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “This would be a headwind to growth but not enough to trigger a recession.”

She continued to recommend phasing into global equities or diversified portfolios to navigate volatility ahead.

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

...moreless

(You can now subscribe to our ETMarkets WhatsApp channel)

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

...moreless

.png)

3 hours ago

2

3 hours ago

2

English (US) ·

English (US) ·