Jul 13, 2025, 12:38:27 PM IST

The Indian market closed in the red for the third consecutive day in a row on Friday. The BSE Sensex fell nearly 700 points, while the Nifty50 closed below 25,200 levels.

ANI

Sectorally, buying was seen in healthcare and FMCG stocks while selling was seen in energy, oil & gas, IT and auto stocks.

iStock

Stocks that hit 52-week high include names like Glenmark Pharma which rose more than 14%, Jaiprakash Power Ventures rose 2.6% and EID Parry India was up 3.7% to hit fresh 52-week high.

THE ECONOMIC TIMES

We spoke to an analyst on how one should look at these stocks the next trading day entirely from an educational point of view:

Analyst: Kunal Kamble, Sr. Technical Research Analyst at Bonanza Portfolio Ltd

ETMarkets.com

5/7

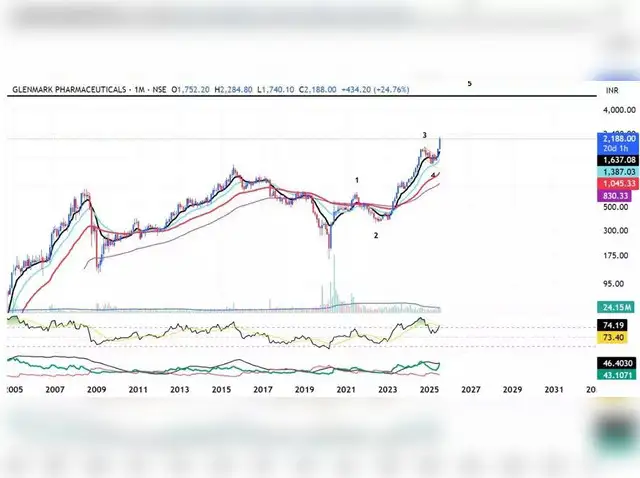

Glenmark Pharmaceuticals Ltd: Target Rs 3,500-5,000

Glenmark Pharmaceuticals Ltd. exhibits strong bullish momentum, confirmed by a flag and pole breakout on the monthly chart. The fifth impulsive wave, rising volume, and price action above key EMAs signal sustained uptrend.

RSI rebounding northward and DI+ trending above DI− highlight ongoing buyer strength, while ADX reinforces momentum reliability. As long as price holds above Rs 1470, dips present potential buying opportunities.

Target levels extend toward Rs 3,500-5,000, supported by pattern projection and trend indicators.

With sentiment and technical alignment, Glenmark stands out as a favorable candidate for medium- to long-term accumulation. This setup reflects consistent interest and directional strength

ETMarkets.com

6/7

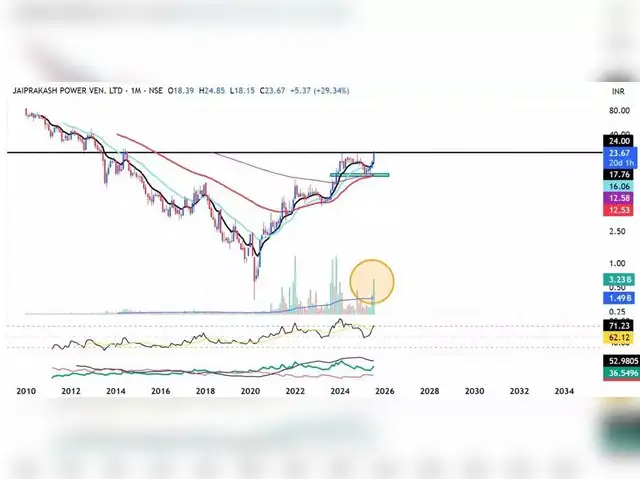

Jaiprakash Power Ventures Ltd: Buy above Rs 24

Jaiprakash Power Ventures Ltd (JP Power) has broken out of a 17-month consolidation zone, supported by rising volume that reflects increased buyer interest.

The stock is approaching its key resistance at ₹24; a close above this level may trigger stronger upside momentum.

Trading above major EMAs indicates bullish sentiment, while the monthly RSI is recovering and moving upward, confirming renewed strength. The setup remains favorable, signaling strong accumulation.

A fresh position can be considered above Rs 24 with a stop-loss at Rs 17. If momentum sustains, the stock holds potential for an upside move toward the Rs 38–₹45 range in the medium term.

ETMarkets.com

7/7

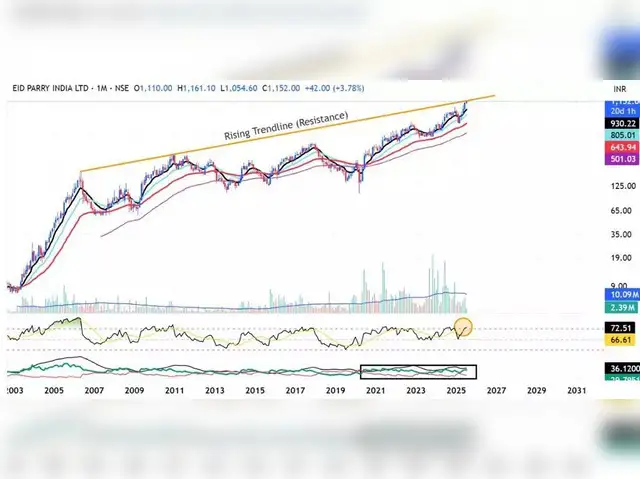

EID Parry India Ltd: Avoid

EID Parry is currently forming a Higher High, Higher Low structure, suggesting an ongoing uptrend. However, the stock has surged toward its rising trendline, which may act as a near-term resistance.

Notably, the decline in volume during this price rise signals weakening momentum. The stock is trading 25% above its mean, while historically it tends to stretch up to 31%, placing the mean near Rs 1222.

The RSI indicator is hovering near the overbought zone, hinting at early signs of exhaustion. Meanwhile, the Directional Indicator remains range-bound, reinforcing a cautious outlook.

Given this setup, the stock may retrace toward its mean, and fresh entries are best avoided at current levels until clearer strength or a pullback emerges.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)

ETMarkets.com

.png)

9 hours ago

1

9 hours ago

1

English (US) ·

English (US) ·