Jun 24, 2025, 05:10:55 PM IST

Indian market bounced back on Tuesday to close in the green. The BSE Sensex rose more than 150 points while the Nifty50 managed to close above 25000.

Agencies

Sectorally, buying was seen in banks, metal, telecom, and auto while selling was visible in IT, oil & gas and energy stocks.

ANI

Stocks thathit a fresh 52-week highinclude names likeMCXwhich were up 0.5%, Bharat Electronics pared gains to close 0.5% lower andBharati Airtelclosed 0.1% lower on Tuesday.

Agencies

We spoke to an analyst on how one should look at these stocks the next trading day entirely from an educational point of view:

Analyst: Rajat Kulshrestha of My Mudra Fincorp Pvt Ltd

ETMarkets.com

The stock has given a breakout and a retest from its resistance level of 8,016. It has moved up 13% or Rs 923 from its last all-time high breakout of Rs 7,102.

Since the stock has broken out, the potential targets are Rs 8,651 (T1) and Rs 9,516 (T2) in the coming days. Strong support and stop loss are at the Rs 6,809 level, provided the price closes above Rs 8,016.

The stock has delivered a strong performance over the past year, gaining 102%, and 17.40% in the last six months.

The stock is experiencing strong buying pressure and has crossed the 50-day moving average in its volume bar on the daily time frame.

ETMarkets.com

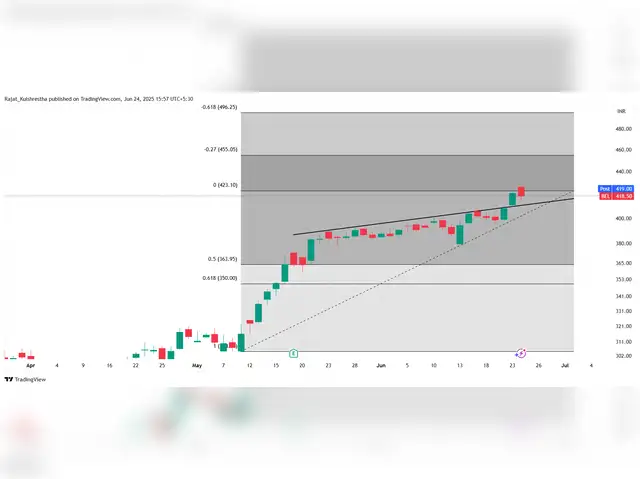

The stock has shown a breakout from its resistance trendline with a large bullish green candle and strong volumes. It is currently trading at its breakout price.

As per Fibonacci analysis, once the price closes above the Rs 423 level, the potential targets are Rs 455 (T1) and Rs 495 (T2) in the coming days. Strong support and stop loss are at the Rs 364 level, provided the price closes above Rs 423.

The stock has delivered solid performance over the past year, rising 35%, and 42% in the last six months.

The stock is witnessing strong buying pressure and has crossed the 50-day moving average in its volume bar on the daily time frame.

ETMarkets.com

The stock has shown a breakout from its resistance zone of Rs 1,888–1,905 with a strong bullish green candle and good volumes. It is currently trading near its breakout price.

The price had been consolidating for the past three months and was rejected three times from this strong resistance zone. The potential target for this stock is Rs 2,057.

The stock has delivered strong performance over the past year, with gains of 36%, and 21% in the last six months.

The stock is showing strong buying pressure and has crossed the 50-day moving average in its volume bar on the daily time frame.

ETMarkets.com

.png)

2 weeks ago

4

2 weeks ago

4

English (US) ·

English (US) ·