There is no shortage of budgeting apps and investment platforms. Among them, it might seem counterintuitive to advocate for a tool as basic as Excel for managing your personal expenses. Despite that, Excel continues to hold its ground as the go-to solution for many individuals and businesses seeking true command over their spending. Many of us, myself included, have downloaded countless apps only to find ourselves returning to the familiar, customizable grid of a spreadsheet.

I’m not banking on the nostalgia factor with Excel. It’s about control, customization, flexibility, and a level of detail that many solutions simply can’t match.

Related

10 free time-saving Excel templates every business needs

Excel templates that will transform how you run your business

Excellent customization and flexibility

Design a spreadsheet as per your needs

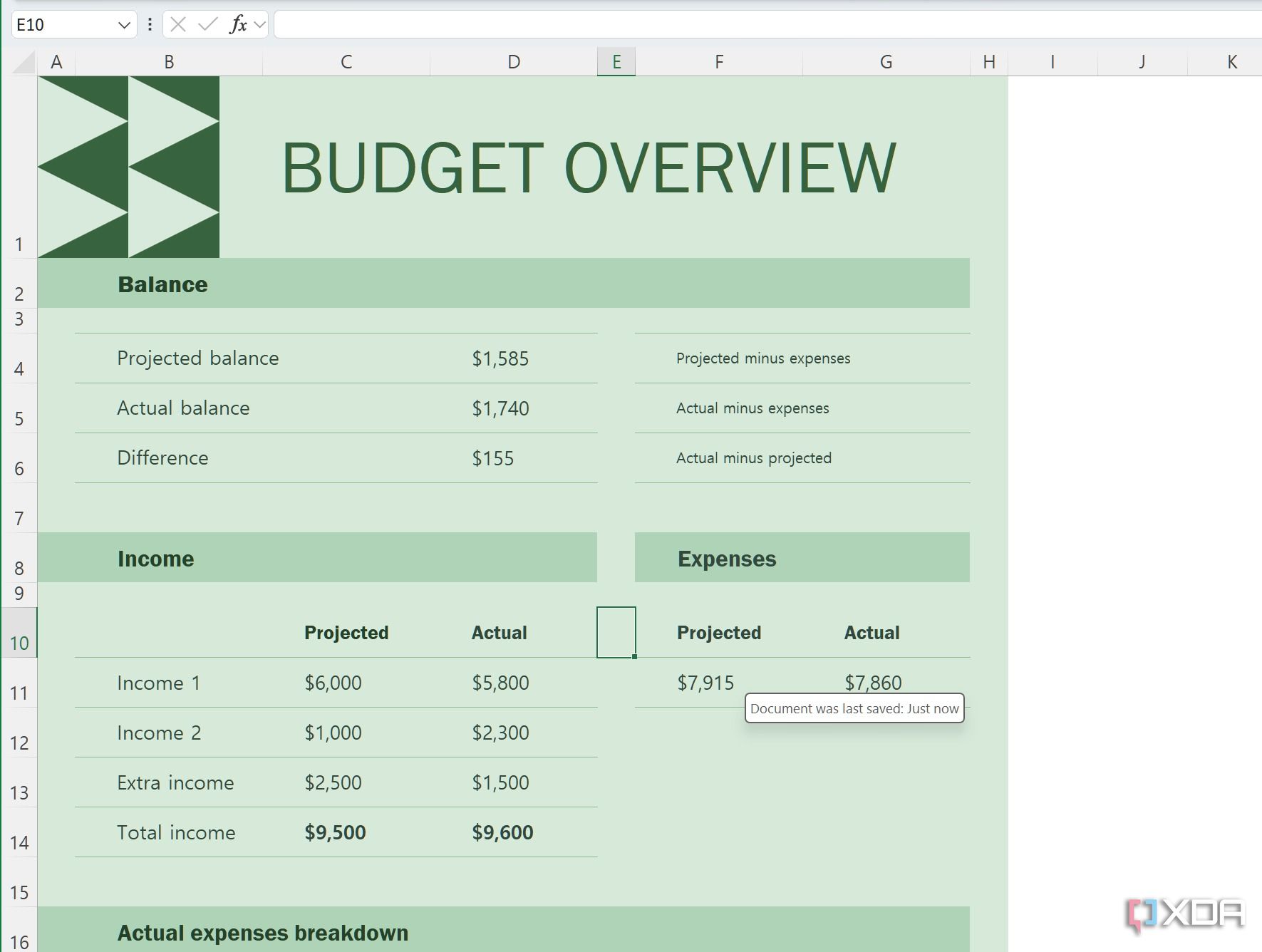

Here is where Excel truly shines. Customization isn’t just a minor feature; it’s the core add-on that allows users to build a personal financial system that perfectly matches their unique needs. Unlike other apps, you don’t need to work with a rigid, pre-defined structure.

Whether you need to track a highly specific sub-category like Dining – Work Lunches versus Dining – Personal or add columns for Payment Method or Project, Excel provides all the required tools to get the job done. You are basically looking at a blank canvas where you have complete control over expense categories, payment methods, description, budgets, and more.

Complete control and ownership of your data

Store your data wherever you want

One of the most comforting aspects of using Excel for my expense management is the complete control and ownership I have over my data. Unlike many finance apps that require me to link my bank accounts or store my sensitive financial information on their servers, my data stays with me.

I can password-protect and save my finance workbook on my computer, an external hard drive, or even a self-hosted cloud service like Nextcloud that I personally manage. I also appreciate that I’m not reliant on an app’s longevity or business model. If a popular finance app decides to change its features, introduce hefty subscription fees, or close operations, I could lose access to years of data. With Excel, that’s simply not a concern.

Endless charts and graphs

Beats any third-party app out there

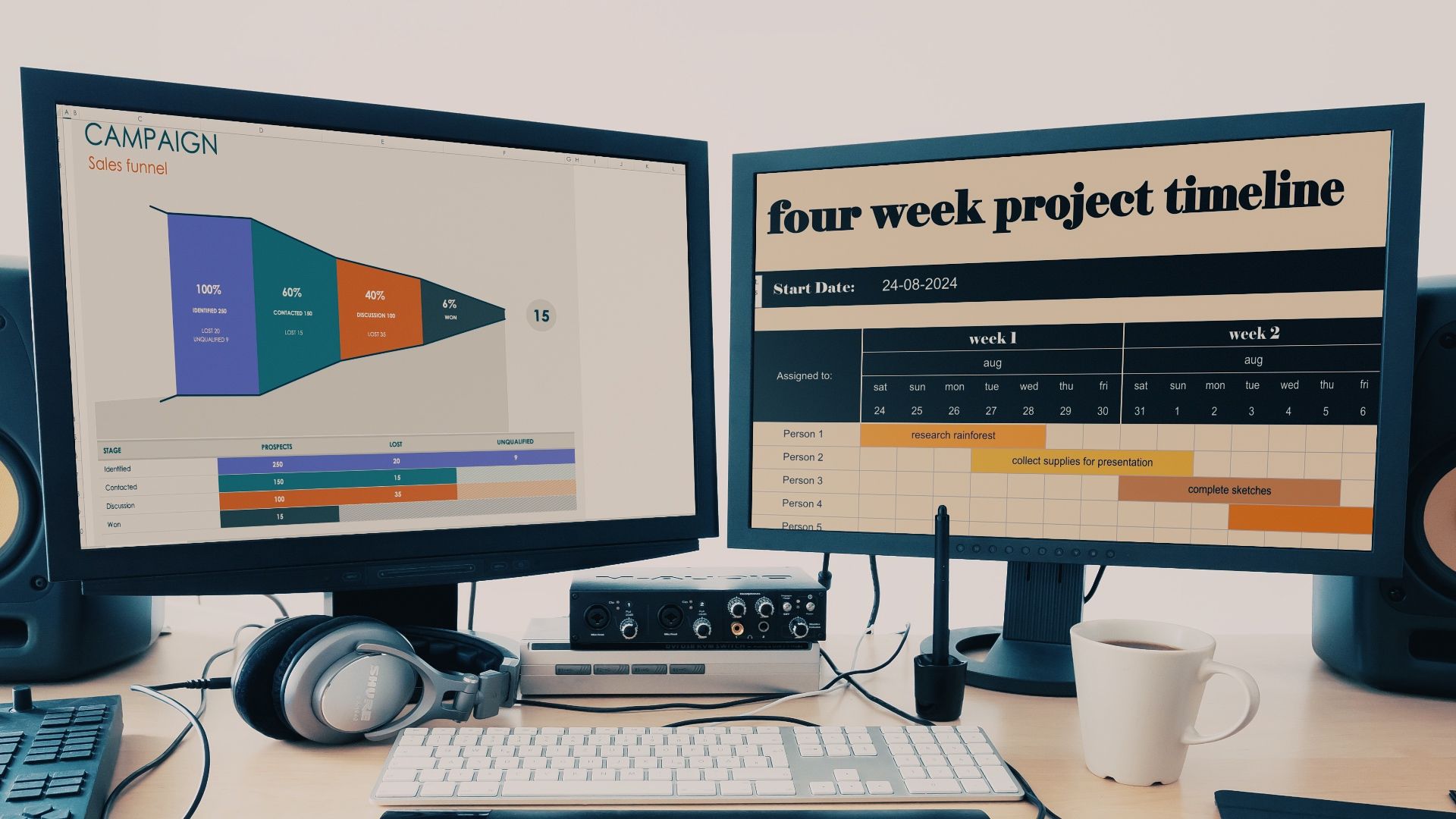

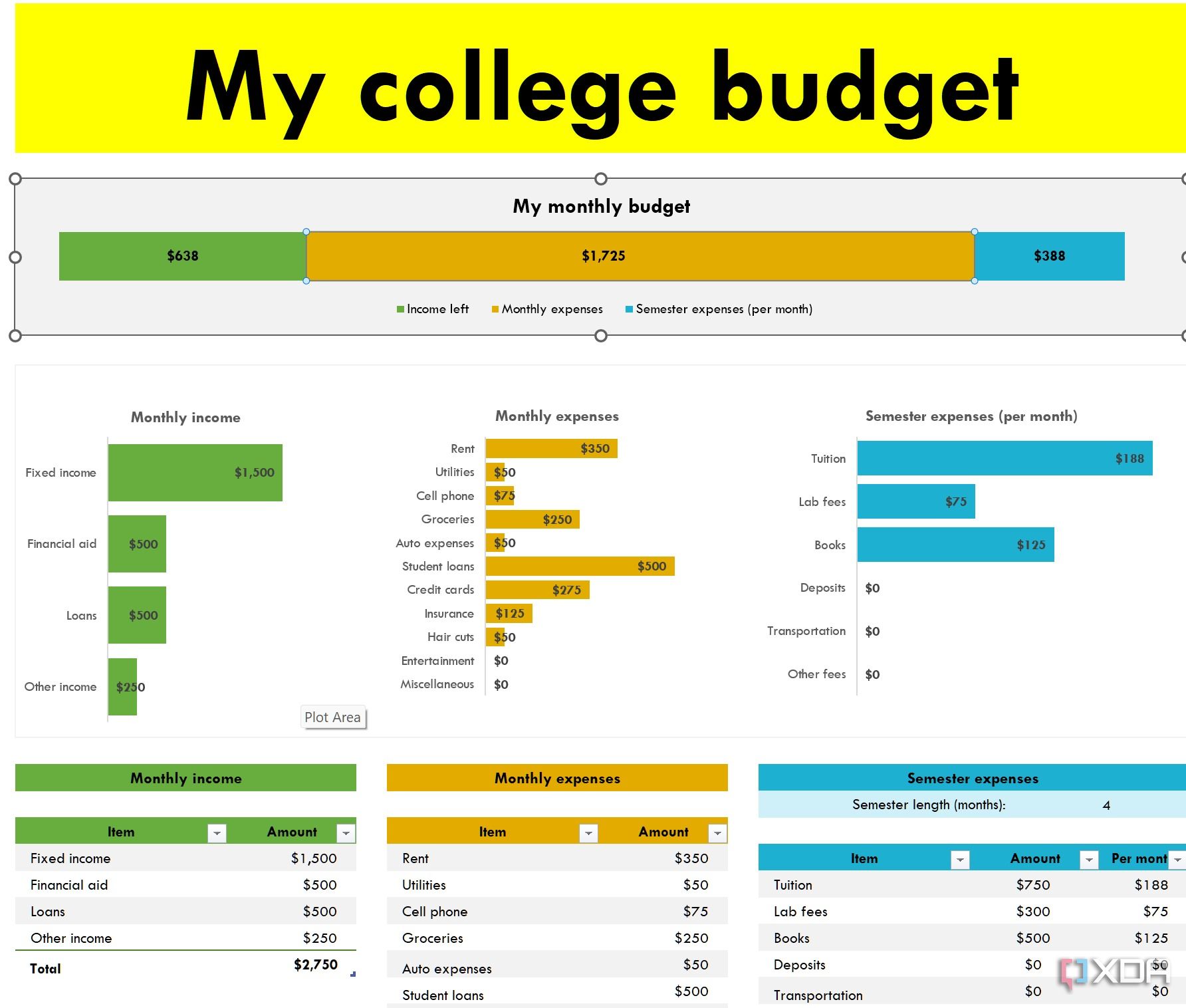

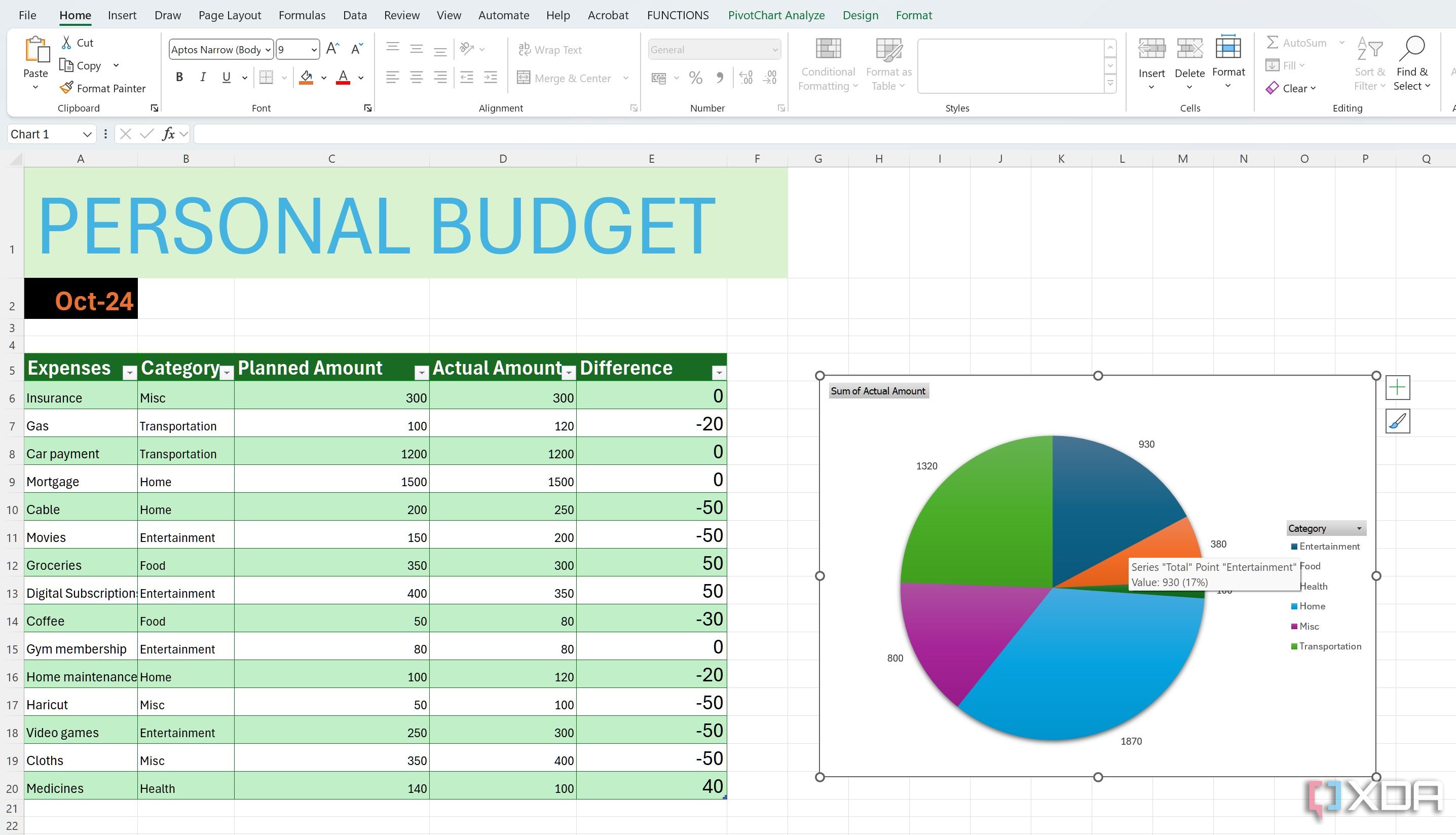

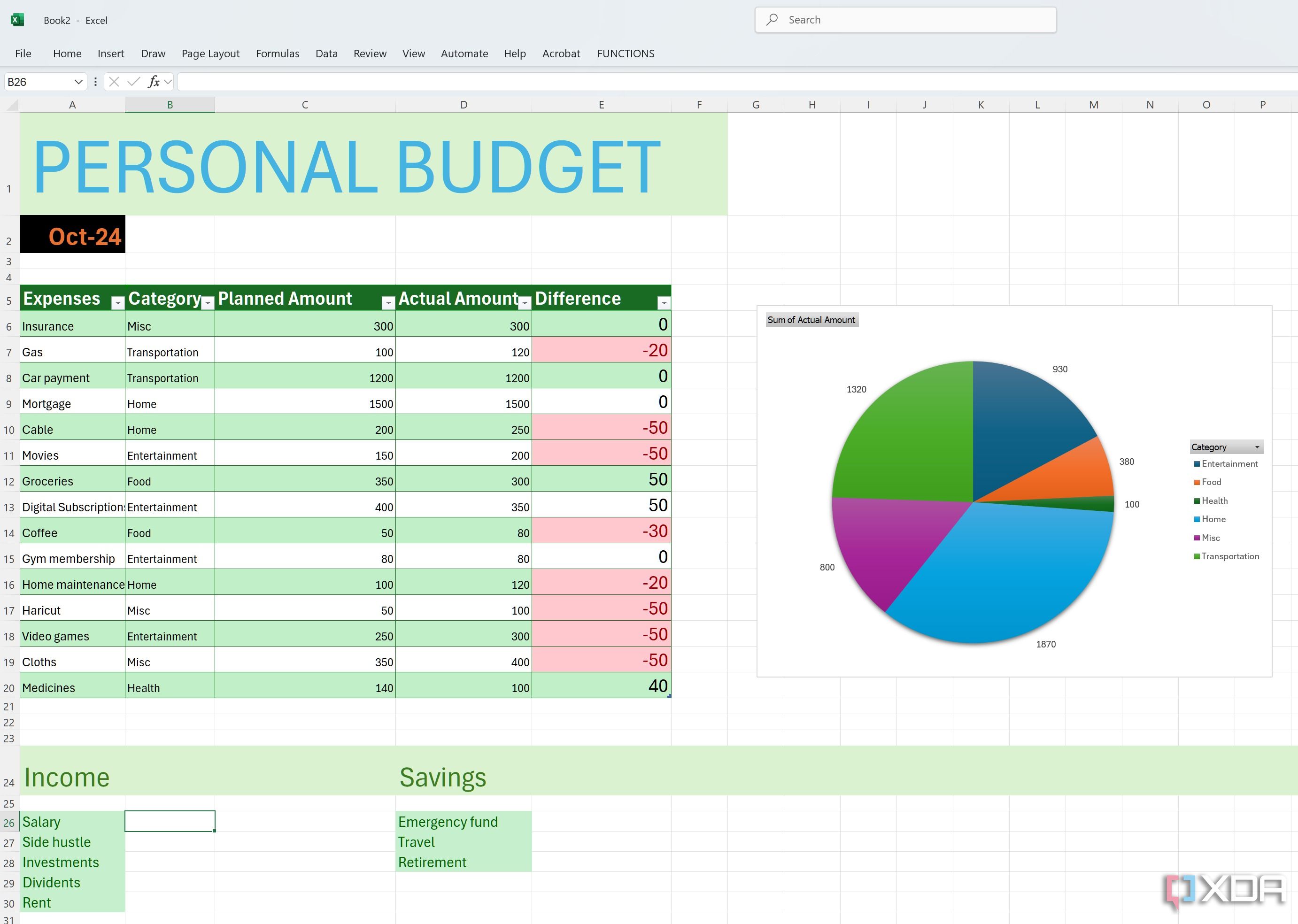

Excel helps me understand my data through an endless array of charts, reports, and PivotTables. This is where I switch from simply tracking my spending to analyzing and gaining powerful insights. For instance, after logging all my transactions, I can create a PivotTable in a matter of seconds.

With PivotTables, I can have a summary of exactly how much I spent on groceries, entertainment, fuel, and more for the month. But that’s just the beginning. I can even add a Month column and have a neat overview of how my spending in each category has changed from January to May. I can easily spot trends.

From that very PivotTable, I can generate a column chart to visually compare my monthly spending across categories or a line chart to see the trend of a specific expense like ‘subscriptions’ over the past year. I can even create a pie chart to understand the proportion of my incoming going to each major expense group. I’m not limited to pre-defined chart types.

Complex calculations and modelling

Excel shines here

Excel beats every other expense tracking app here. This is where I can move beyond just tracking what I have spent and start predicting and planning for what I will spend. For example, I’m not just totalling my monthly expenses, I can build formulas to analyze trends.

For example, I can use an AVERAGEIF function to see my average spending on groceries on weekends, or a SUMIFS to calculate how much I have spent on online shopping from specific vendors. This level of conditional analysis helps me pinpoint spending habits I might not even be aware of. I can even use the PMT function to instantly calculate what my monthly payments would be given different interest rates and loan terms. Overall, I have ample ways to play around with the numbers.

Flawless collaboration

Excel supports robust collaboration where I can share the entire workbook with my partner and keep track of expenses. I can even password-protect the sheet to keep prying eyes away from it. Besides, I already subscribe to Microsoft 365 for other essential tools like Word and PowerPoint for my work and personal projects.

And since Excel is a part of Microsoft 365, I don’t have to spend any extra for managing my expenses.

The OG of expense tracking

While the market is saturated with advanced finance apps, many of them come with a hidden cost: less control, limited customization, and often, a subscription fee. Excel, on the other hand, is a powerful and cost-effective tool for managing your expenses. Also, with dozens of ready-to-use finance templates, you don’t even need to start from scratch. What are you waiting for? Fire up your familiar software with rows and columns and start designing the perfect monthly balance sheet.

While you are at it, check out these best Excel functions for finance and accounting.

.png)

English (US) ·

English (US) ·