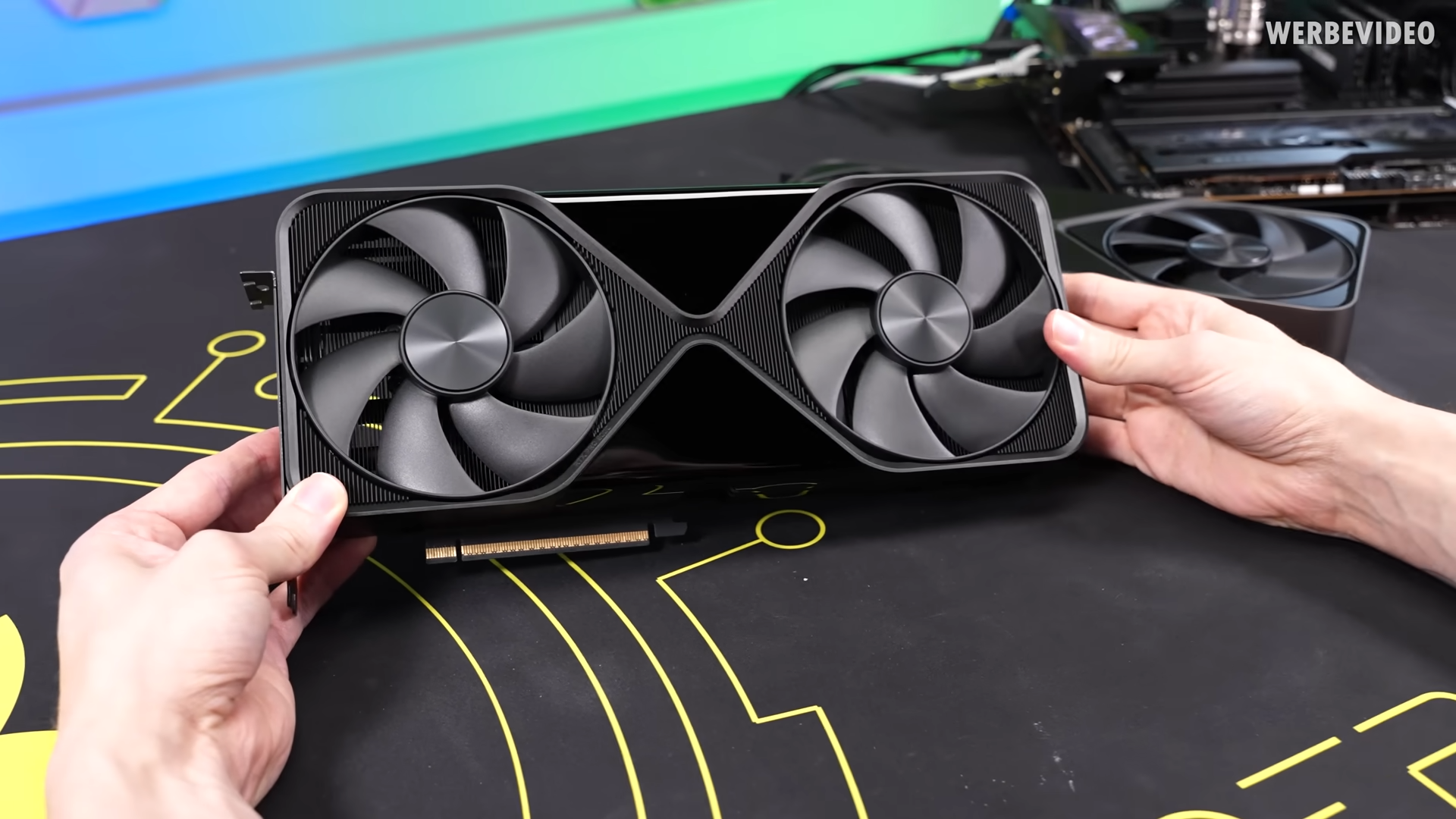

If you're active in the PC hardware space, you'd think that this year hasn't been kind to Nvidia. The launch of its RTX 50 series GPUs has been marred by driver issues, burning connectors, and poor stock. Pair that with questionable marketing statements like "4090 performance for $549", and you get to where we are now.

But where are we exactly? We PC hardware enthusiasts might hold the opinion that while Nvidia is certainly still a giant in the consumer PC hardware space, it's had a rough year. The RTX 5060 launch certainly hasn't done them any favors. The reality is, Nvidia's priority no longer aligns with the consumer space; they have much bigger fish to fry, and their decisions in the last few years make a lot more sense when you look at their revenue data.

From humble beginnings to gaming giant

Nvidia built up a ton of brand power with gamers

Source: Flickr

Source: Flickr

Nvidia couldn't be further removed from its humble Denny's origin story. After its inception over crappy coffee in late 1992, Nvidia went on to take over the GPU industry, and they had their sights set on the gaming market from the beginning. While there were many companies trying to cash in on the need for graphics acceleration (most of them with more capital than Nvidia at the time), Nvidia was one of the only companies to enter the 2000s with a somewhat successful business.

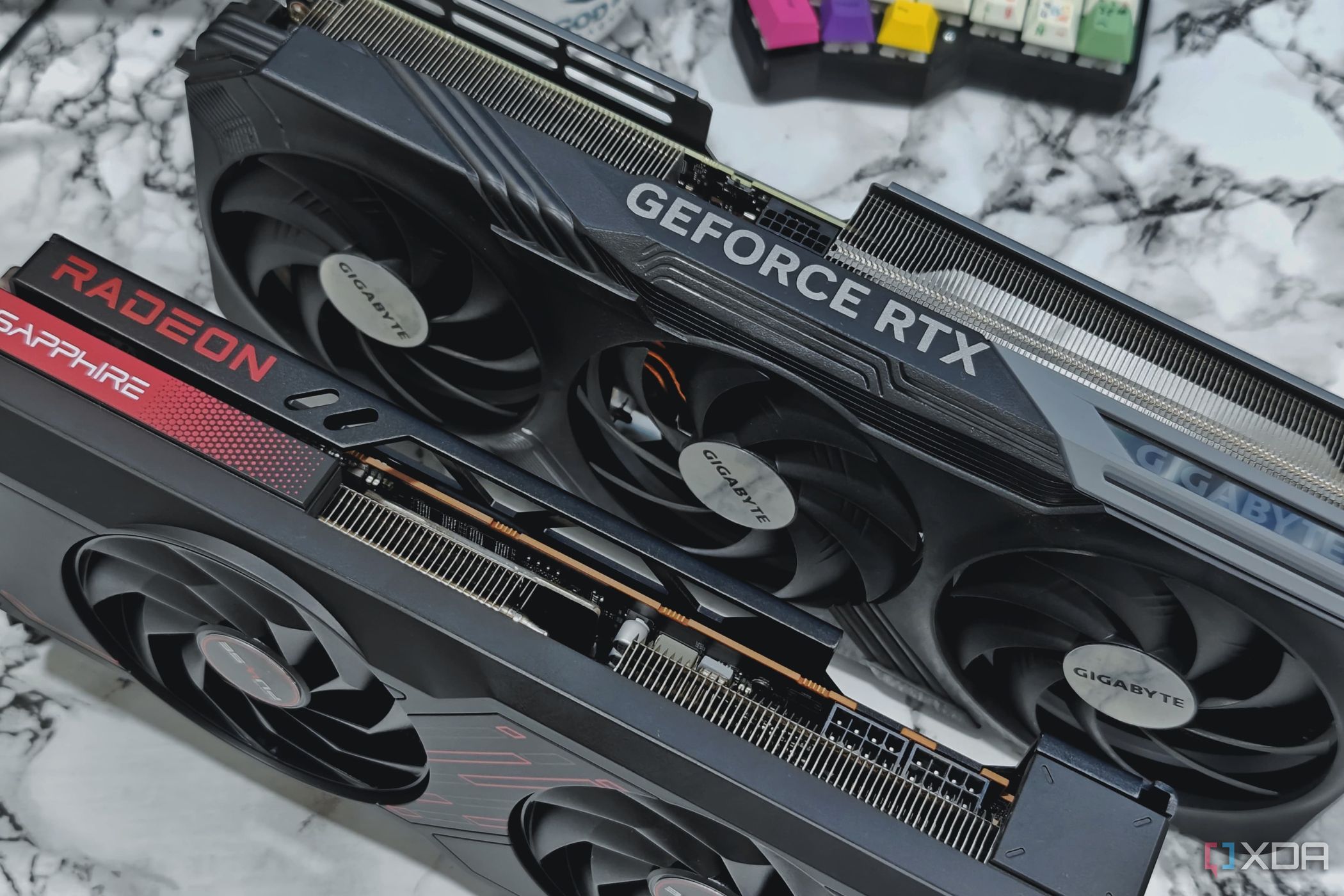

GeForce was born out of an emerging market for discrete graphics, and because of this, its brand has such staying power with gamers and hobbyists alike. Gaming was not just such a large part of why Nvidia became successful in the first place, but it was also what kept the ball rolling for them. ATI, later bought by AMD, just couldn't innovate and push performance to the same degree. Entering into the 2010s, GeForce cards were becoming the de facto choice for gamers and professionals.

There was more money to be made

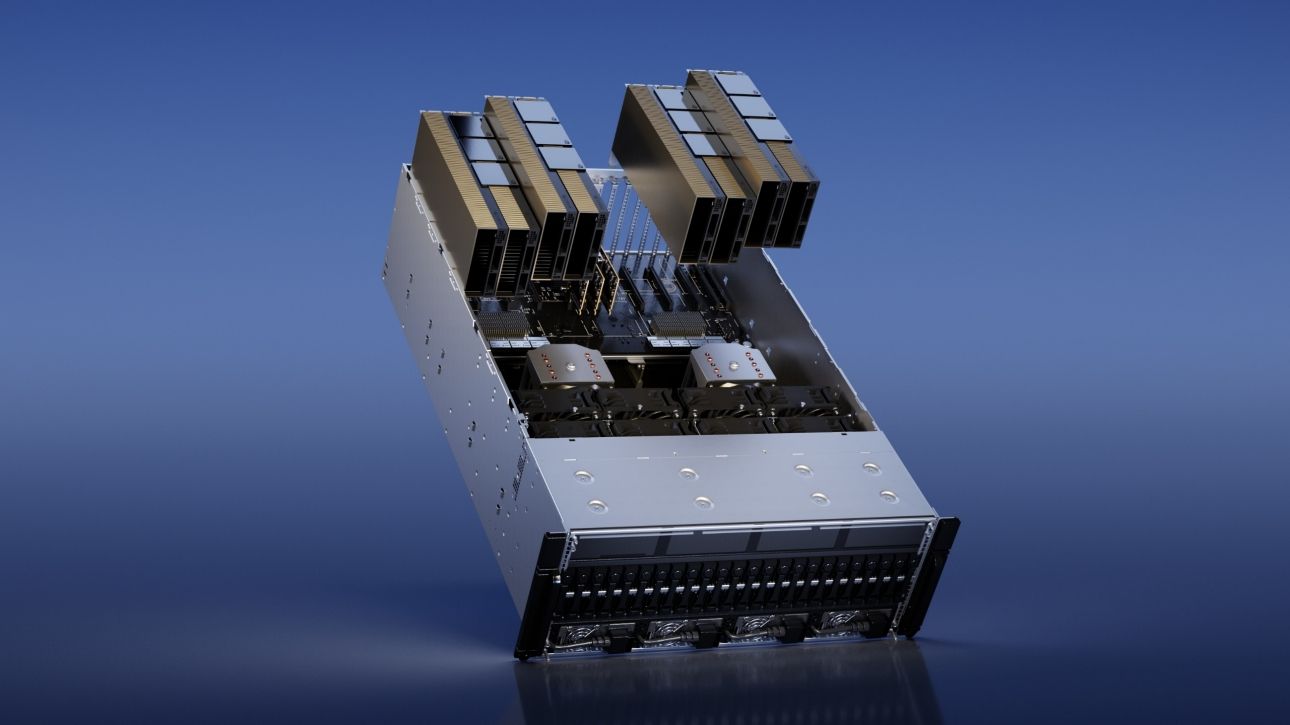

Enterprise GPUs are more profitable

Nvidia H100 // Source: Nvidia

Nvidia H100 // Source: Nvidia

Nvidia, like many companies in the semiconductor industry, makes significantly more money selling their enterprise equipment than they do selling consumer-grade silicon. That's why they've made a very concerted effort to buy up companies that specialize in the enterprise space, like Cumulus Technologies, Mellanox Technologies and many more. Expanding their scope was always something that was going to happen, but the AI-boom of the last few years took Nvidia to even greater heights.

Suddenly, the silicon they were making had exponentially higher potential profit if it were to be made into an enterprise card versus a consumer one. If you thought an RTX 5090 was expensive, Nvidia's compute cards are in a league of their own. Cards such as the H100 can run well into the tens of thousands of dollars. Blackwell's B100 is similar, but companies aren't usually buying single GPUs—they're buying complete systems that can be worth millions of dollars on their own.

Related

5 things I wish I knew before buying a used GPU

It's not as risky as it was once made out to be, but buying used GPUs still has its pitfalls.

Looking at the data

It all starts to make sense

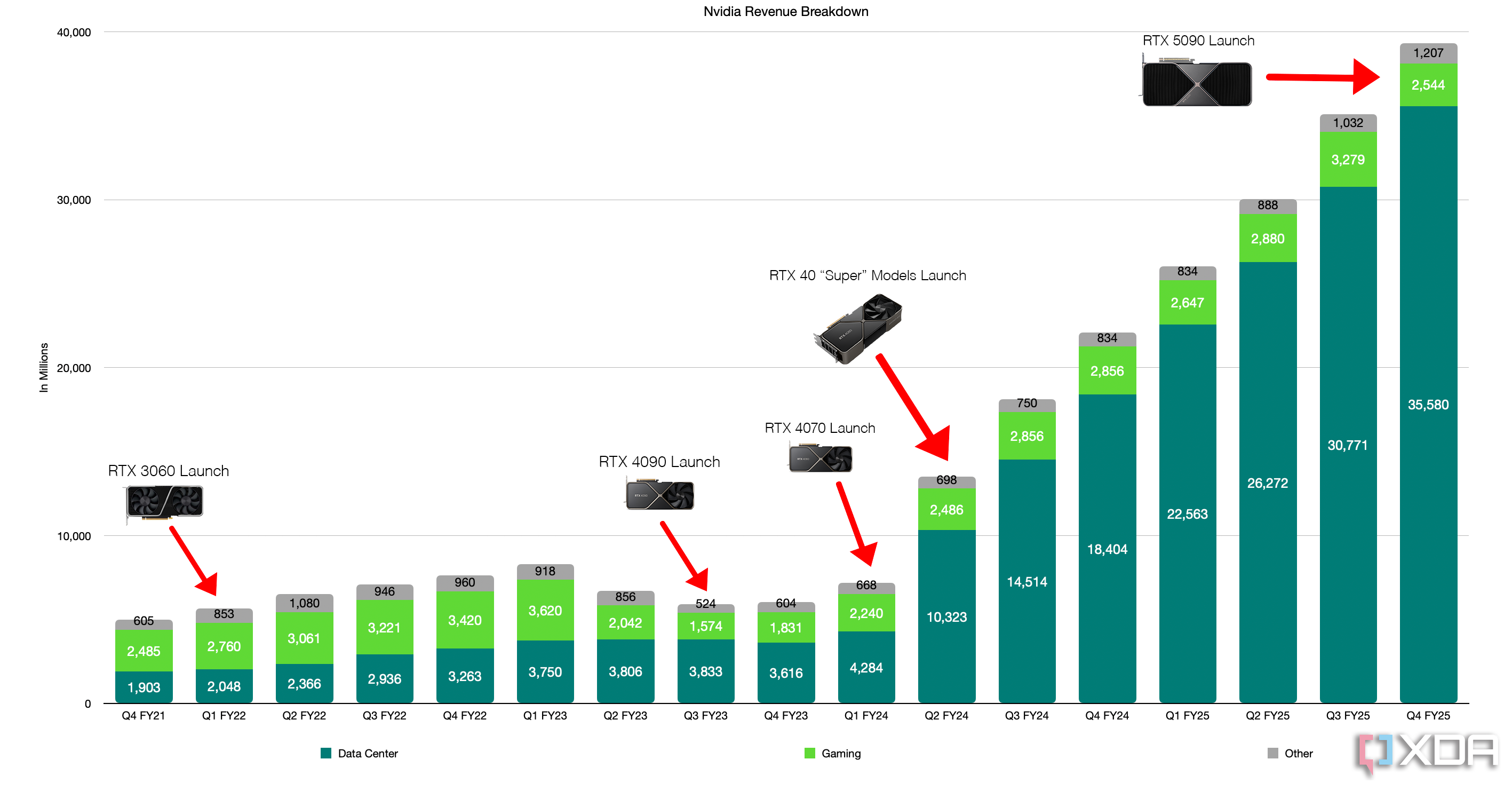

When you begin to even brush the surface of Nvidia's revenue data, their strange treatment of the gaming and hobbyist market becomes a lot more understandable. Looking at the breakdown done in App Economy Insights' "How They Make Money" newsletter, we can see that around the tail end of the RTX 30 series launches, Nvidia was still making a very significant chunk of revenue from the gaming sector. The launch of the RTX 40 Series and the eventual Super models coincides with the AI boom of late 2022, when the demand for enterprise compute GPUs had just begun to skyrocket. Their revenue from gaming GPUs was no longer growing, and their revenue from the data center sector doubled from Q1 2024 to Q2 2024, and continued to balloon from there.

For gamers, hobbyists and even professionals, it's a pretty sobering graph to look at. Nvidia hasn't just outgrown the gaming sector, they've done so more than tenfold. It all starts to make a lot more sense as to why Nvidia has treated the GeForce brand the way they have. The revenue they made from the gaming sector in Q4 of 2024 doesn't even cover their operating costs. It's even less than the tax they had to pay.

The complaints about pricing, stock, gaming performance, VRAM constraints—all of them fall on deaf ears, drowned out by the sound of whining server fans and the low hum of commercial-grade air conditioning. The sweet sound of data center revenue. Despite what CEO Jensen Huang has said about Nvidia's commitment to gamers, their actions tell a slightly different story. But who can blame them? When your company suddenly becomes the powerhouse in a completely different industry that also happens to use the same, extremely valuable materials, you shift your focus onto that.

What choice are gamers left with?

AMD and Intel can step up big time

This data affirms something big for the rest of the consumer GPU industry: there's going to be space to step up. GeForce has a ton of brand power, but that brand power is still probably worth less than Nvidia's current data center portfolio. Their recent actions suggest they still value the brand, but they might not be willing to compete on price with the smaller manufacturers. The goodwill they've built up with system integrators and consumers is powerful to say the least, so why not continue to ride it?

Their recent treatment of the media during the launch of the RTX 5060 was labeled as ethically questionable by some, and the more negative press that comes out about the Green Team, the more market share that will be up for grabs in future GPU releases. AMD and Intel have a big opportunity to capture a chunk of the mid-range, which is already happening with the RX 9000 and Battlemage GPUs, respectively. The high-end has been abandoned by AMD because of an inability to compete with Nvidia's highest-end offerings, but there's only so many people that will be able to afford a $2000+ GPU. The future is uncertain, and the shake-up is just beginning.

Nvidia will be just fine, but the industry is changing rapidly

Nvidia's primary source of revenue is no longer consumer GPUs, and as a result, their focus has shifted. Their QA mishaps, stock struggles, and dubious attitude towards media outlets during recent releases start to make a lot more sense. They aren't attempting to outright distance themselves from the gaming space, but they certainly see it through a much different lens. The door is ajar for AMD and Intel, but it's up to them to step through with both feet.

.png)

English (US) ·

English (US) ·