With dozens of spreadsheets, scattered receipts, and a constant worry about where your money is actually going, managing personal finances can often feel like a daunting task. For years, I struggled to find an accounting solution that was both robust enough to give me a clear picture of my financial health and didn’t come with a hefty price tag or a steep learning curve. That’s when I discovered GnuCash, a free and open-source accounting software designed with both personal and small business users in mind.

At first, it started as a simple experiment, and despite some gripes (more on that later), GnuCash has transformed how I view and manage my money, and frankly, I’m not going back to my old ways.

Cross-platform availability

Accessible on all my devices

Unlike MoneyCoach, Budget Flow, and many more, GnuCash offers incredible cross-platform compatibility. I frequently jump between my Windows desktop for work, my MacBook for creative projects, and a Linux desktop that serves as my home server and self-hosting projects. The thought of having my financial data locked into a single ecosystem was always a huge barrier for me.

With GnuCash, I can download and install the exact same software on all my devices. Also, it’s not a light version for one OS and a full-featured one for another – it’s the same powerful solution across the board. I can just save my GnuCash data file on Nextcloud, and no matter which computer I’m on, I can open that same file with my local GnuCash installation and make entries. As for mobile flexibility, I’m exploring the GnuCash Pocket companion app on my Pixel 8.

Checkbook-style register

Intuitive for entering transactions

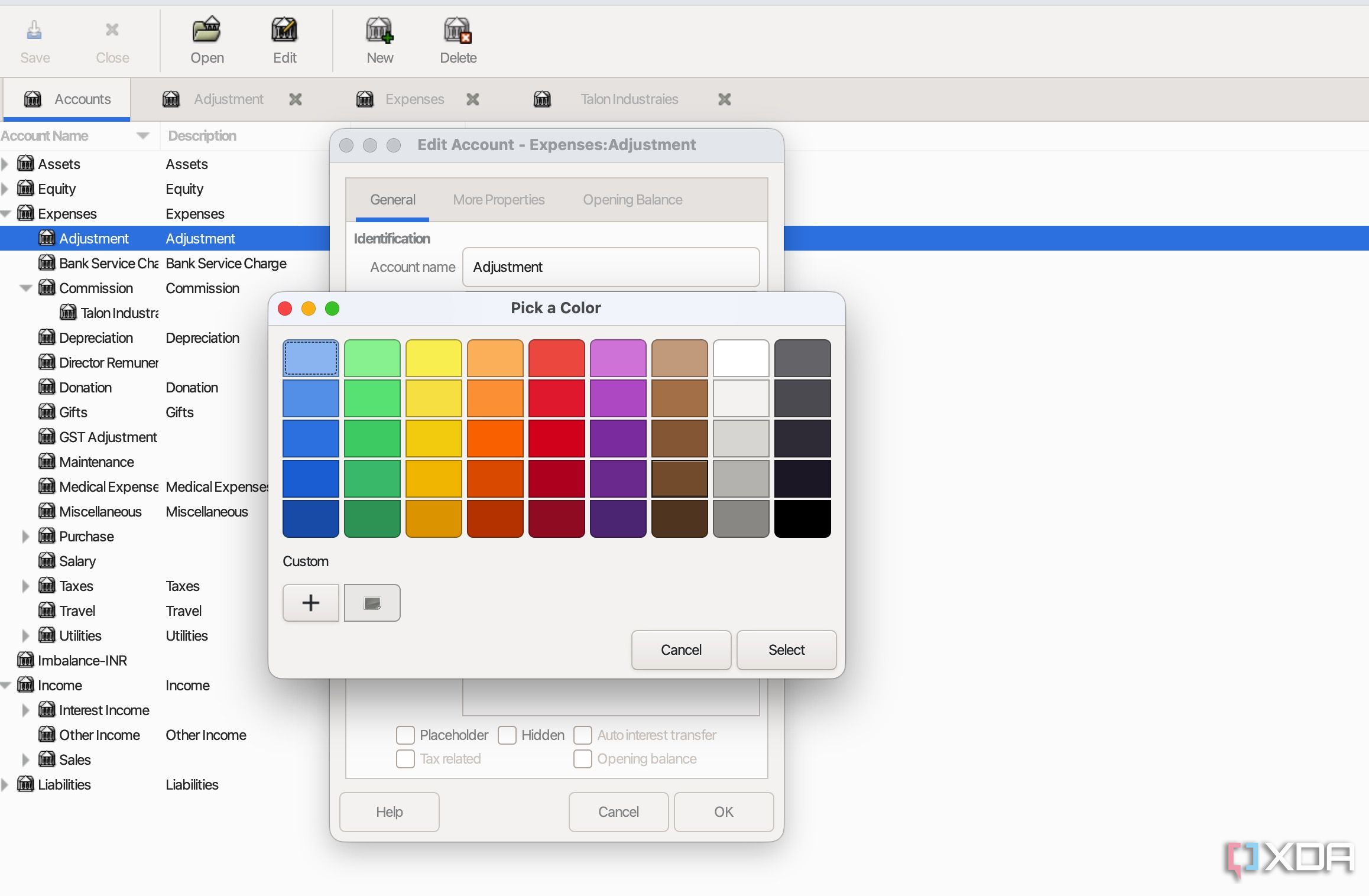

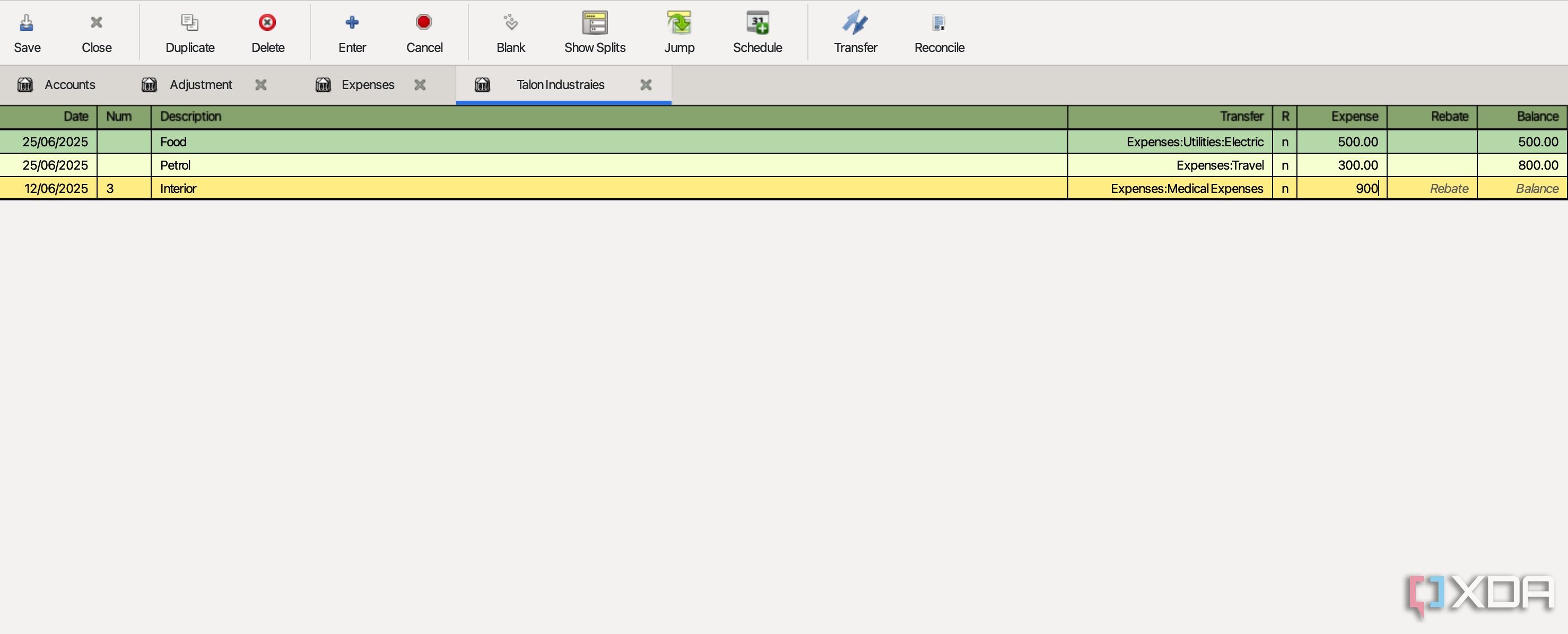

When I first opened GnuCash, one of the features that immediately made me feel at home was its checkbook-style register. If you have ever balanced a physical checkbook or even used basic budgeting apps, you will find this interface familiar. It’s laid out just like a traditional ledger where you have columns for date, transaction number, description, withdrawals, deposits, and a running balance.

This familiar layout made entering transactions a breeze for me. I just pick the right account (like my checking account or credit card), type in the date, add a quick description like ‘Groceries at DMart’, input the amount, and categorize it. Overall, I know exactly where my money is going without feeling like I’m doing complex accounting.

Schedule transactions

Add a touch of automation

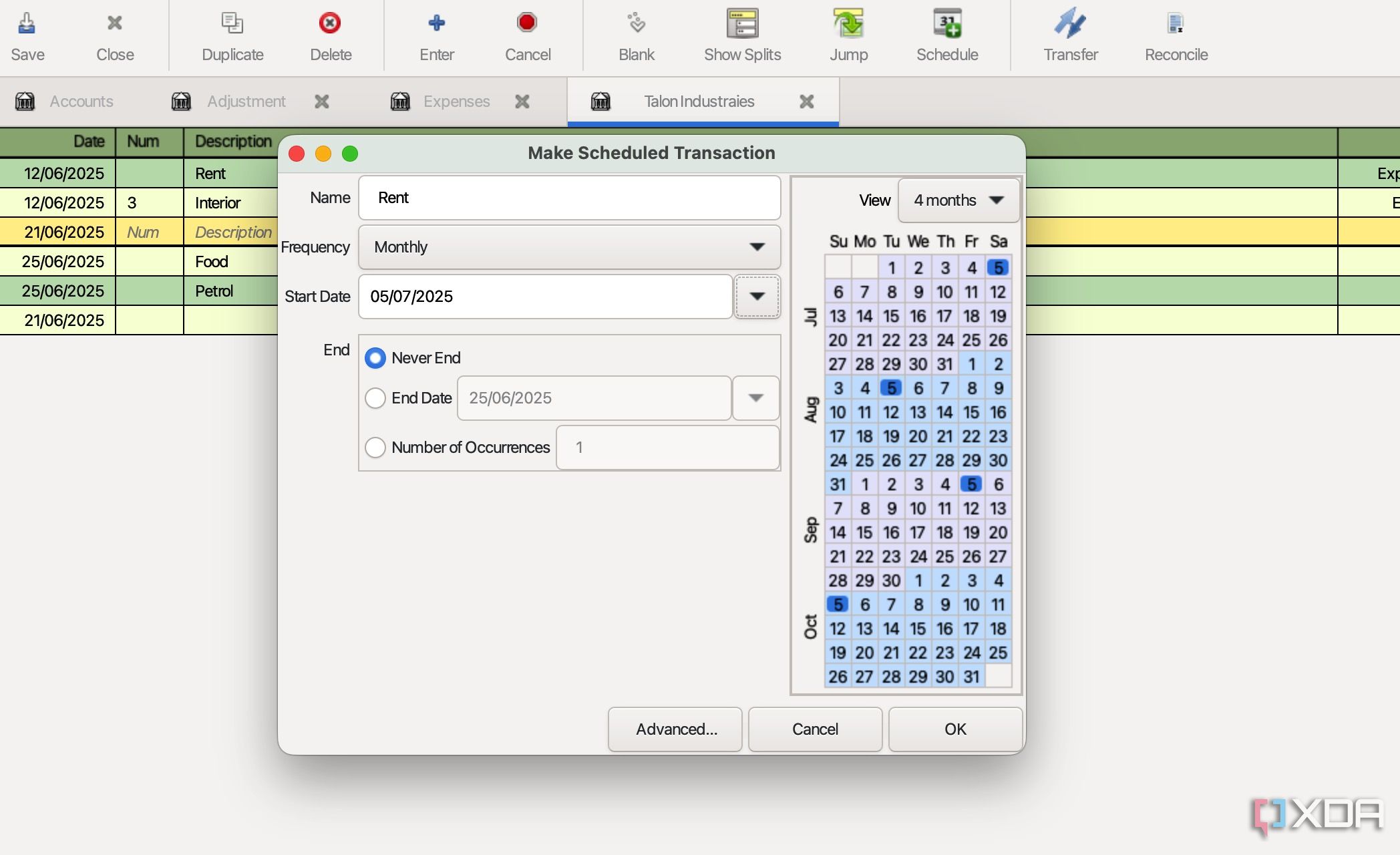

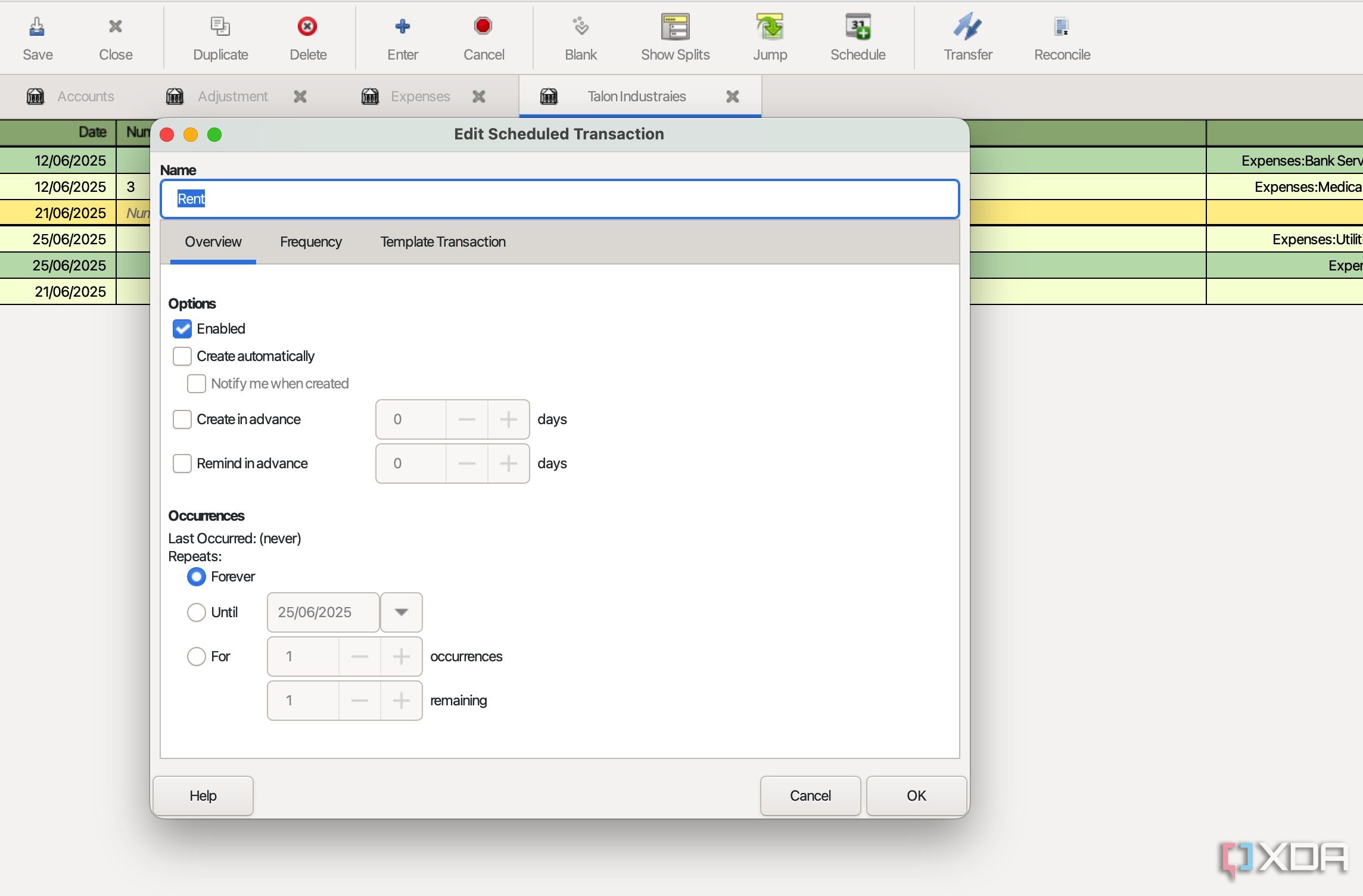

One of the biggest time-savers in GnuCash for me has been the scheduled transactions feature. Let’s face it, we all have those bills that come like clockwork: rent, loan payments, subscriptions, salary deposits, and more. Manually entering them every month is tedious and easy to forget.

This is where GnuCash shines. I can set up a transaction once, tell GnuCash how often it occurs, and then let the software handle the reminders and creation of entries. Take my rent, for example. Every month, on the 5th, a fixed amount (₹25,000) of money leaves my bank account for ‘Rent Expense’. I simply set up a scheduled transaction and ensure I never miss logging those recurring payments.

Support for reports and graphs

Advanced features for small businesses

Like any budgeting and finance app, GnuCash offers a bunch of reports and graphs to see my overall net worth at any given moment. This visual feedback helps me identify trends and make better financial decisions, rather than just staring at columns of numbers.

While my personal finances are primarily in Indian Rupees, GnuCash’s support for multiple currencies is something I find reassuring. For someone like me who loves to travel and occasionally has transactions in USD or EUR, this means I can easily set up a foreign currency bank account and integrate it with my main INR accounts.

Other useful features include statement reconciliation, where I can compare bank statements with GnuCash transactions, the ability to track investments, and more. I haven’t leveraged these features yet, but it's reassuring to see these add-ons built right in.

Related

5 self‑hosted finance apps that export perfectly into Excel for deeper analysis

These are the best open-source financial apps you can self-host and export data for further analysis in Excel.

An open-source solution

Have peace of mind

GnuCash is an open-source solution, which means that the software’s source code is publicly available for anyone to review and modify. Besides, it’s completely free to download and use. There are no hidden fees or premium versions locked behind a paywall. The community support and continuous improvement are right up there with other robust open-source apps like Grocy.

Ready to ditch paid software?

Adopting GnuCash has been a crucial step in my financial journey. It proved that robust, feature-rich accounting doesn’t have to come with a hefty price tag or a complex interface. While it may not offer the flashy, cloud-based integration of some of its rivals, the fundamentals are solid.

From tracking daily expenses to managing investments and even light small business accounting, GnuCash gives me financial clarity. It’s far from perfect, though. The UI desperately needs a makeover with fresh animations and icons. Overall, if you are ready to take charge of your finances without breaking the bank, I highly recommend giving GnuCash a try. If it doesn’t work for you, check out this post to find more finance apps.

.png)

English (US) ·

English (US) ·