With dozens of bank accounts and credit card statements, loan documents, investment reports, and budgeting spreadsheets, it’s easy to get overwhelmed with your finances. For years, I navigated personal finance feeling disorganized and frankly, a bit lost. Financial advisors felt out of reach, and spreadsheets often led to more confusion than clarity.

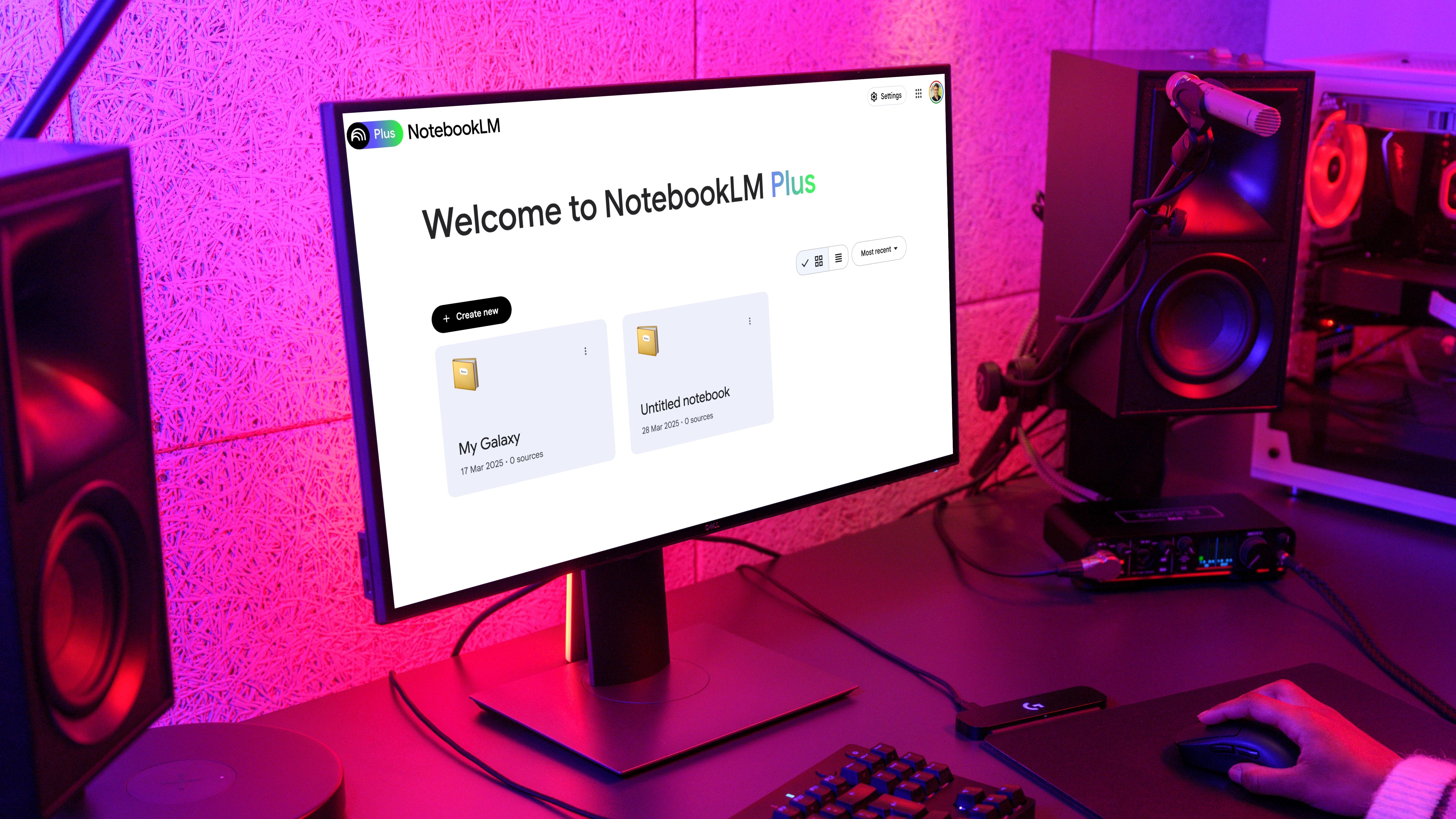

But what if I told you that a surprising tool, one you might already use for notes and research, completely transformed my financial life? That tool is NotebookLM, and I have turned it into my personal financial expert. Here’s how Google’s AI note-taking tool brought clarity, control, and calm to my money.

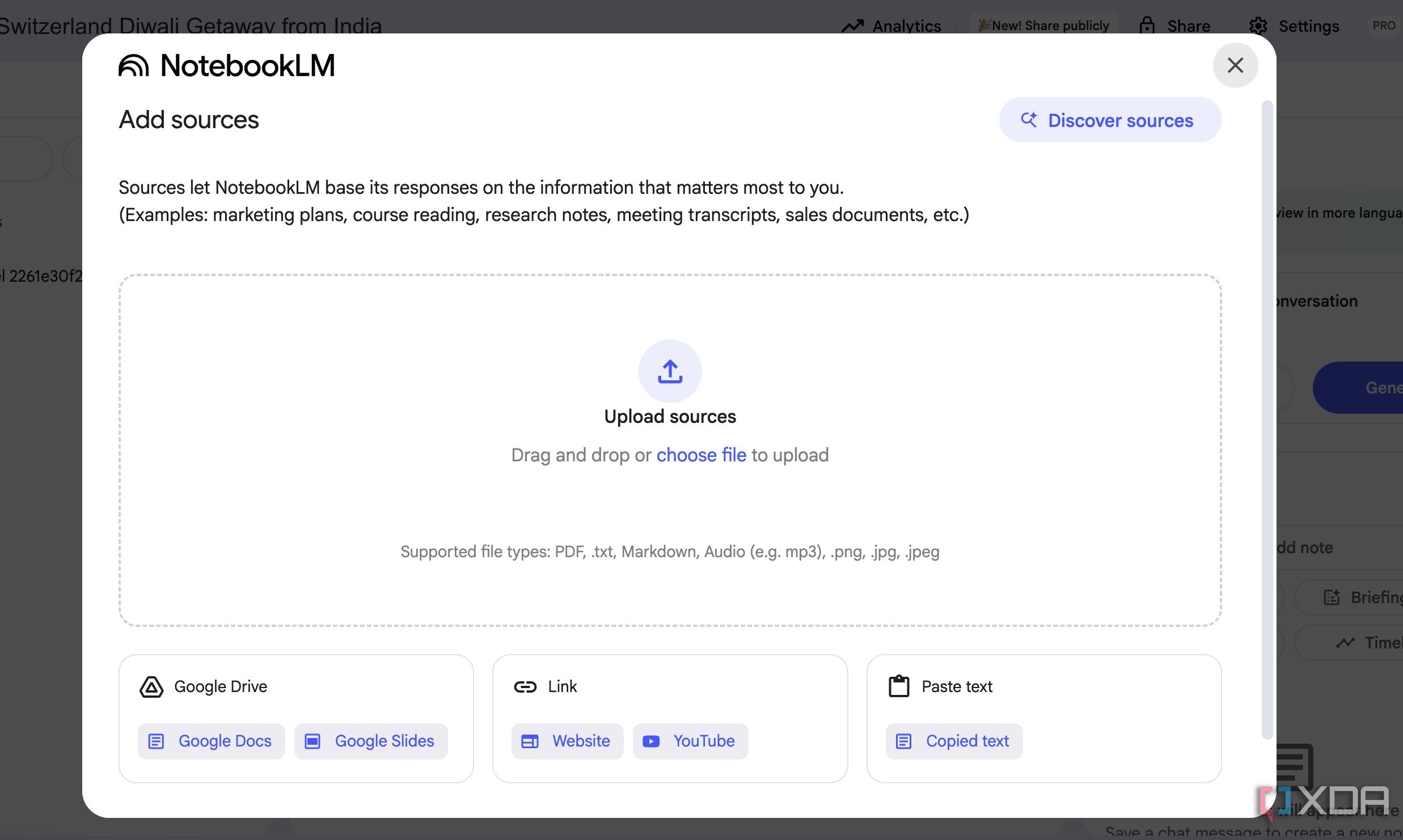

NotebookLM supports all the relevant file types

Except for spreadsheets, but there is a trick

Let’s go over the basics first. When I decided to centralize my financial information in NotebookLM, I was initially concerned about getting all my diverse data into one place. For instance, my bank statements and credit card statements usually arrive as PDFs, and NotebookLM handles them without breaking a sweat.

The same goes for my investment reports from various platforms, which are also typically in PDF format. I can upload my quarterly summaries from my brokerage, my mutual statements, or even detailed performance reports.

Beyond standard PDFs, I also have a lot of financial information in Google Docs. This includes my budget plans, summaries of articles I have read about retirement planning, or even a simple list of financial goals.

Now, let’s talk about spreadsheets. While NotebookLM doesn’t support them by default, I have discovered a simple and effective workaround: exporting them as a PDF.

When I’m done updating my monthly budget in Google Sheets or when I want to analyze a particular investment performance spreadsheet, I simply export it as a PDF and make it ready for upload to NotebookLM.

Decoding my bank statements with NotebookLM

Find where you spent money

The process of getting my bank statements into NotebookLM is straightforward. I simply log into my online banking portal, download all my bank statements for the relevant period. I usually opt for the ‘Download PDF’ option.

I download the entire financial year statement and upload it to my NotebookLM notebook. I also upload another one from the current account and start asking it questions in natural language, just as I would a human advisor.

- Who are the main entities sending and receiving funds from this account during the financial year 2024-25?

- Point out the five largest debit transactions from April 2024 to March 2025.

- Summarize all transactions related to Amazon for the past 12 months and provide the total amount spent.

- Identify any recurring monthly subscriptions or payments that appear in this statement.

After all, ghost subscriptions are a common drain on finances. NotebookLM is brilliant at picking those recurring charges, whether it’s streaming services, gym memberships, or irrelevant IPTV subscriptions.

Related

I self-host these 5 apps to manage my finances

These neat services keep my wallet nice and happy

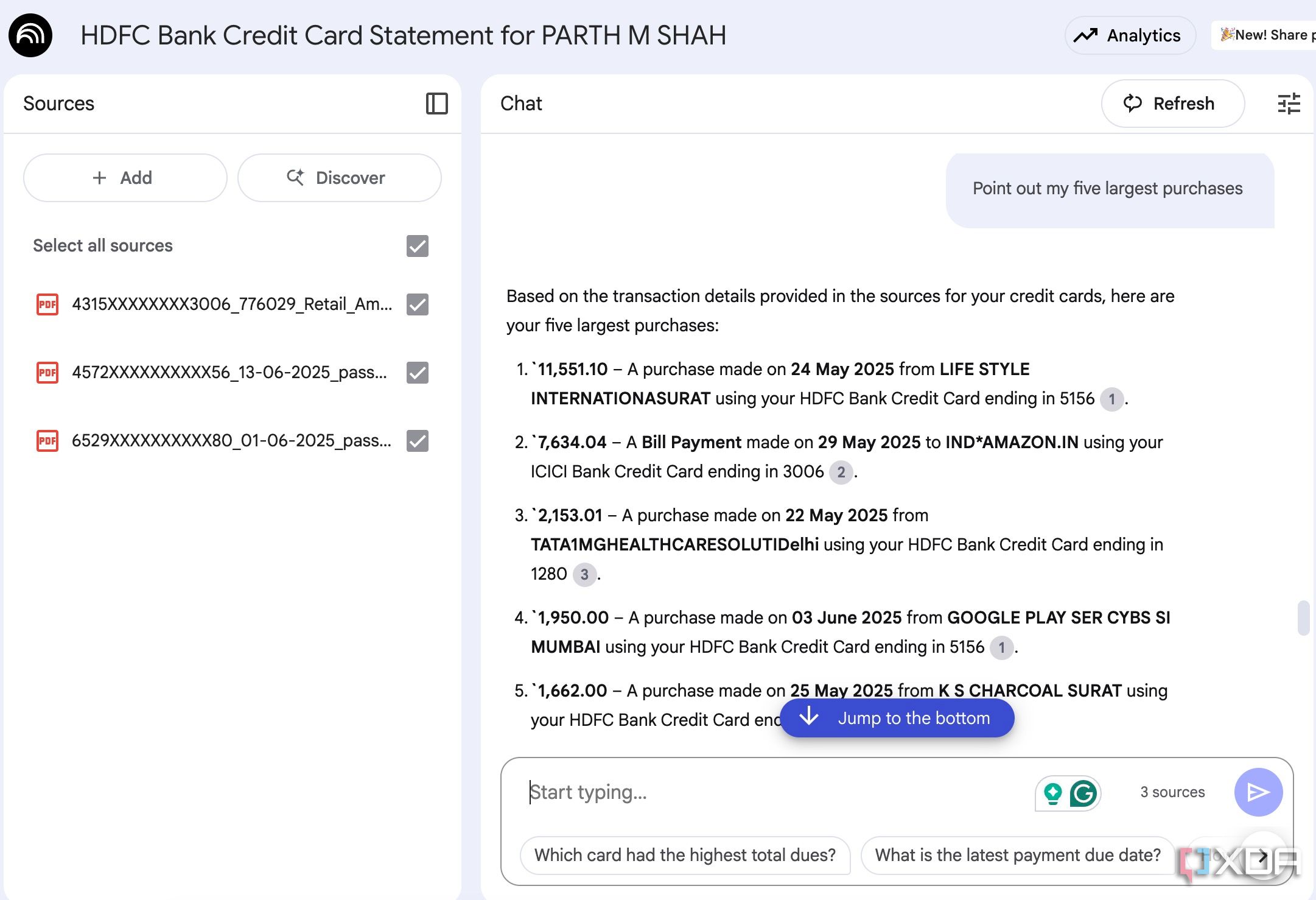

Understanding credit card bills with NotebookLM

Ans tracking reward points

I handle credit card statements from five different banks. The process of moving credit card bills to NotebookLM is similar to how I handle bank statements.

Once all my credit card statements are loaded, I can start asking NotebookLM specific questions that would otherwise require manual review across multiple documents.

I can ask ‘ Summarize my spending on online shopping across all cards for the last quarter’ and receive a consolidated view of spending in categories. I can even ask ‘Point out the five largest transactions across all credit cards’ and understand where the bulk of my credit card spending is going.

Overall, NotebookLM saves me significant time and ensures I’m always informed about my balances, due dates, rewards points, and spending patterns.

Other unique use cases to consider

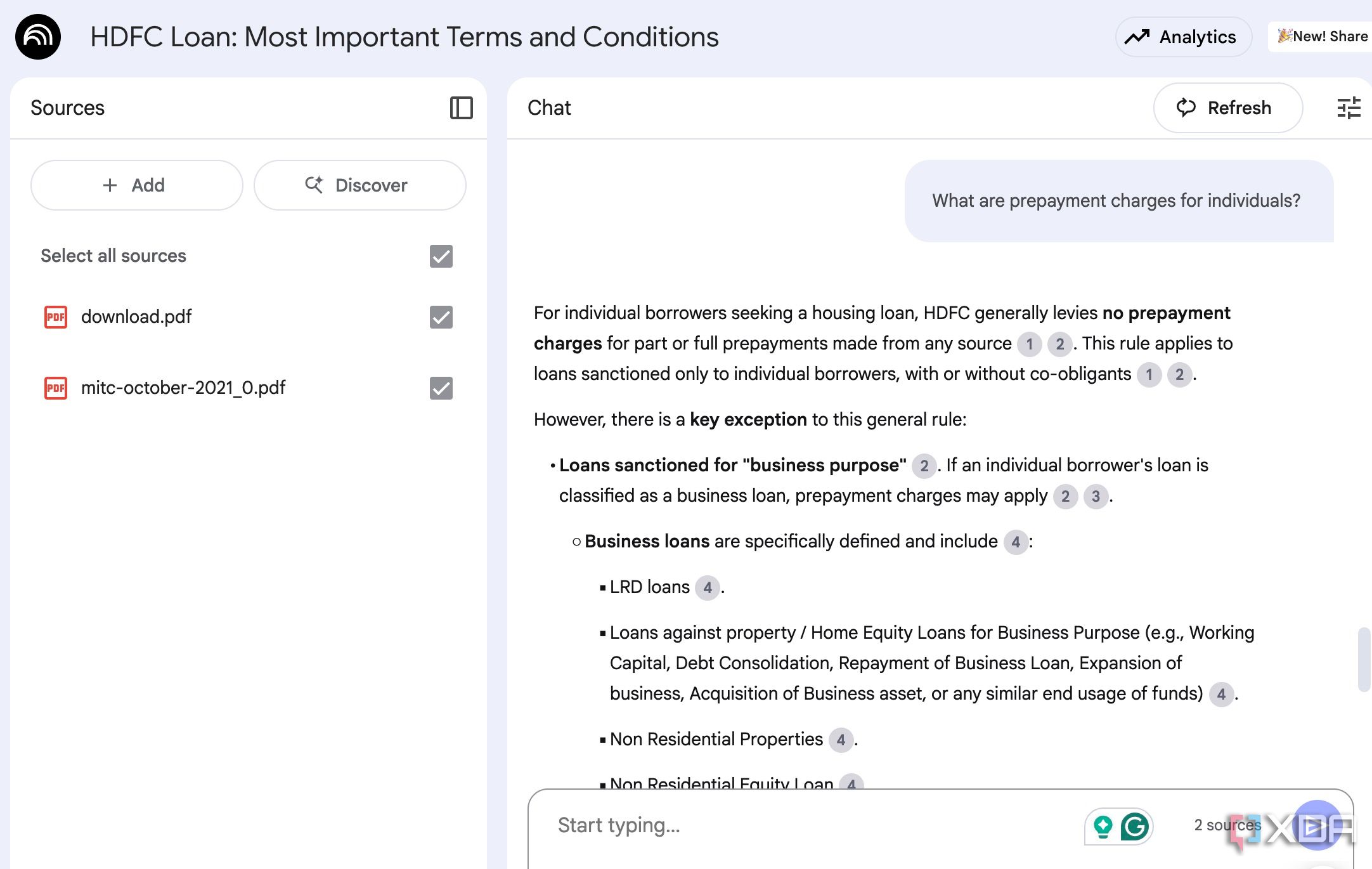

Get insights from loan documents and investment reports

While credit card and bank statements are fantastic for day-to-day financial tracking, NotebookLM truly shines when it comes to navigating complex documents we rarely read fully, like loan agreements, insurance policies, or investment terms and conditions.

For instance, I can insert a 10-page home load terms and conditions PDF file into NotebookLM and ask the following questions.

- What are all the charges, fees, and penalties associated with this home loan?

- What are the prepayment charges for individuals?

- Are there any processing fees?

- What documents and approvals are required before each disbursement?

And the list goes on. Overall, NotebookLM transforms those overwhelming documents into actionable information and helps me make better financial decisions in no time.

Level up your money game

For far too long, I dreamed of having a personal financial expert side-by-side to provide instant clarity and actionable insights without breaking the bank. And NotebookLM turned out to be just that tool.

If the idea of understanding and controlling your finances feels out of reach, I urge you to give NotebookLM a try. It began as a simple experiment with a couple of credit card bills, and quickly transformed my relationship with money. Aside from financial expert, there are other unique ways I use NotebookLM to get the best out of it.

.png)

English (US) ·

English (US) ·